Home Insurance Your home is not just a place to live; it’s also a significant investment. To protect your haven from unforeseen events and potential risks, having the right home insurance is essential.

Home insurance provides financial protection, property coverage, and liability coverage, ensuring that you can recover and rebuild in the face of unfortunate circumstances.

In this article, we will delve into the world of home insurance, its importance, different policy types, factors affecting premiums, and tips for choosing the right coverage for your home. More info Home Insurance

What is Home Insurance?

Home insurance, also known as homeowner’s insurance, is a vital form of property insurance that offers comprehensive coverage for both your home and its contents.

It offers financial protection against damages or losses caused by perils such as fire, theft, vandalism, and natural disasters. Home insurance policies typically consist of different coverages, including property damage, personal liability, and additional living expenses.

Importance of Home Insurance

Home insurance is vital for several reasons:

| Financial Protection | Property Protection | Liability Coverage |

|---|---|---|

| Home insurance provides financial security by covering repair or replacement costs in case of damage to your home or belongings. It helps you avoid substantial financial losses and ensures that you can rebuild or repair your home if disaster strikes. | Your home is likely one of your most significant investments. Home insurance safeguards your property against various risks, including fire, theft, vandalism, and severe weather events. It offers peace of mind, knowing that you can recover from such incidents without a significant financial burden. | Home insurance also includes liability coverage, which protects you if someone gets injured on your property and sues for damages. It covers medical expenses, legal fees, and potential settlements, helping you navigate potential legal liabilities. |

Types of Home Insurance Policies

There are various types of home insurance policies available to homeowners, offering different levels of coverage and protection for their properties and belongings. The most common policy forms include:

| Policy Type | Coverage Offered |

|---|---|

| HO-1: Basic Form | Provides limited coverage for specific perils listed in the policy, such as fire, lightning, windstorms, hail, explosions, and theft. It offers minimal coverage compared to other policy forms. |

| HO-2: Broad Form | Offers coverage for a broader range of perils, including falling objects, weight of ice or snow, freezing of plumbing systems, and accidental water damage, in addition to the perils covered in the basic form. |

| HO-3: Special Form | Also known as an open perils policy, provides coverage for all perils except those specifically excluded. It offers comprehensive coverage for the structure of the home and personal belongings, making it a common and preferred option. |

| HO-4: Renter’s Insurance | Designed for tenants renting a property, covering personal belongings and liability but not the structure itself, which is the landlord’s responsibility. |

| HO-5: Comprehensive Form | Offers the highest level of coverage for both the structure and personal belongings, including coverage for all perils except those explicitly excluded, providing extensive protection for homeowners. |

| HO-6: Condo Insurance | Specifically tailored for condominium owners, covering personal property, liability, and portions of the physical structure that are the owner’s responsibility. |

| HO-7: Mobile Home Insurance | Designed for mobile or manufactured homes, providing coverage for the structure, personal belongings, and liability, protecting mobile homeowners from specific risks associated with their type of dwelling. |

| HO-8: Older Home Insurance | Tailored for homes that may not meet the replacement cost value criteria of other policy types, considering the unique characteristics and potential challenges of insuring older homes. |

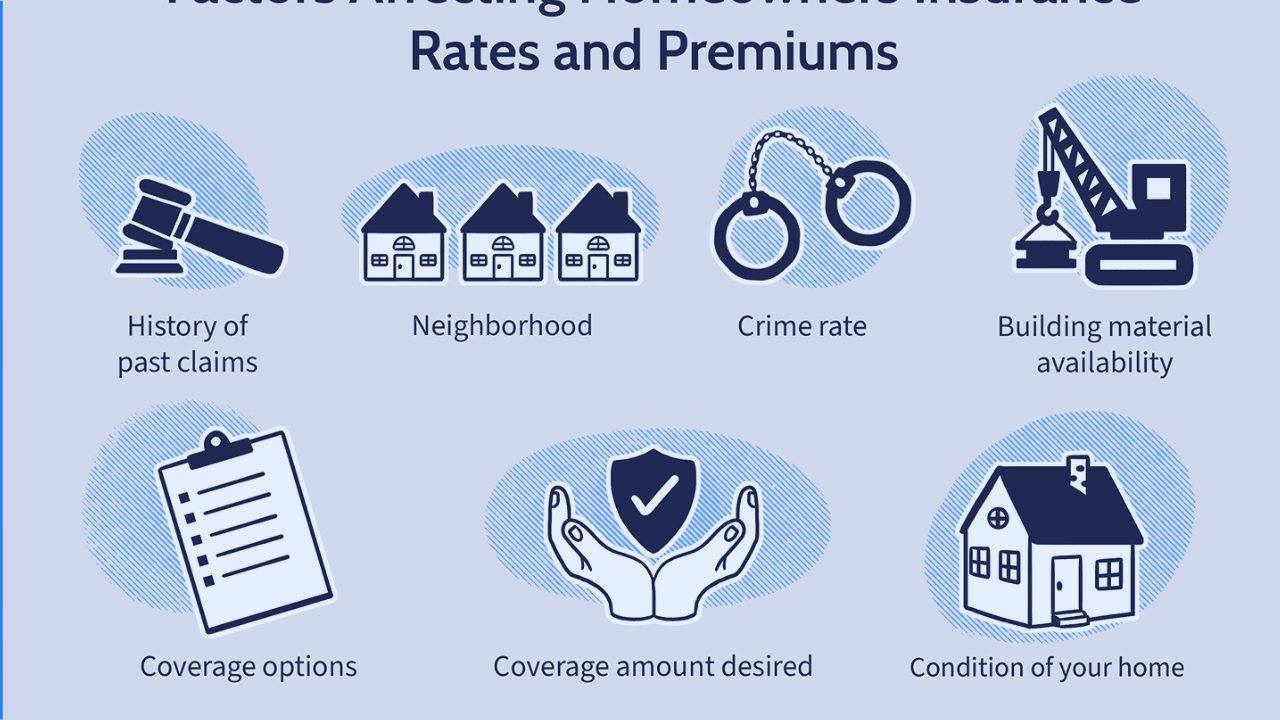

Factors Affecting Home Insurance Premiums

Several factors influence home insurance premiums. Understanding these factors can empower you to make informed decisions when choosing the right home insurance coverage for your needs and ensuring your property and belongings are adequately protected.

| Factors Affecting Insurance Premiums | Impact on Premiums |

|---|---|

| Location | The location of your home can impact premiums due to factors like proximity to fire stations, natural disaster frequency, and crime rates. |

| Home Value and Construction | Higher home values and expensive construction materials/features may lead to higher premiums. |

| Deductibles and Coverage Limits | Higher deductibles can result in lower premiums, while higher coverage limits may lead to higher premiums. |

| Security Systems and Safety Features | Homes with security systems and safety features may qualify for discounts, as they reduce the risk of damages and enhance home safety. |

| Claim History | A history of previous claims may increase premiums, as it may be perceived as a higher risk property by insurers. |

How to Choose the Right Home Insurance

Selecting the right home insurance involves careful consideration of your needs and researching insurance providers.

Here are some helpful tips to guide you through the process and make informed decisions when selecting the right home insurance coverage for your property and belongings:

Assess Your Needs Evaluate your property and determine the coverage you require. Consider factors such as the value of your home, the contents you want to protect, and any specific risks associated with your location.

Research Insurance Providers Research reputable insurance providers in your area. Read reviews, check their financial stability, and assess their customer service and claims handling reputation.

Compare Quotes and Coverage Obtain quotes from multiple insurance providers and compare their coverage, deductibles, and premiums.

When choosing a home insurance policy, it’s essential to strike a balance between affordability and comprehensive coverage. To ensure you get the most suitable and cost-effective home insurance coverage, compare different options carefully.

Assess coverage, deductibles, premiums, and additional benefits from various insurers. Consider your home’s value, location, and specific risks in your area.

This comparison will help you make an informed decision, finding the best fit for your needs and budget, and providing peace of mind for you and your family.

Read the Policy Carefully Before committing to a policy, read it carefully and understand the coverage, exclusions, and terms. Pay attention to the details, including policy limits, deductibles, and any additional endorsements or riders.

Conclusion

Home insurance is a crucial safeguard for protecting your haven from unforeseen events and risks.

It provides financial security, property protection, and liability coverage, ensuring that you can rebuild and recover from potential damages.

Understanding the different policy types, factors affecting premiums, and how to choose the right coverage will help you make informed decisions when selecting home insurance.

Invest in comprehensive home insurance to secure your dwelling and enjoy peace of mind knowing that you are protected.

Leave a Reply